Turkey’s economy outperformed all peers except China in the final quarter of last year, driven by lower interest rates and a credit binge that boosted domestic consumption while destabilizing the currency.

Gross domestic product expanded 5.9% from a year earlier, faster than all G-20 nations except China’s 6.5%. The median of 20 forecasts in a Bloomberg survey was for 6.9% expansion.

The government’s growth push in 2020 saw the currency weaken by 20%, keeping consumer inflation in double digits for the entire year. The data expose the challenges facing central bank Governor Naci Agbal as he looks to cool growth and restore price stability without triggering a steep slowdown in activity and a jump in unemployment.

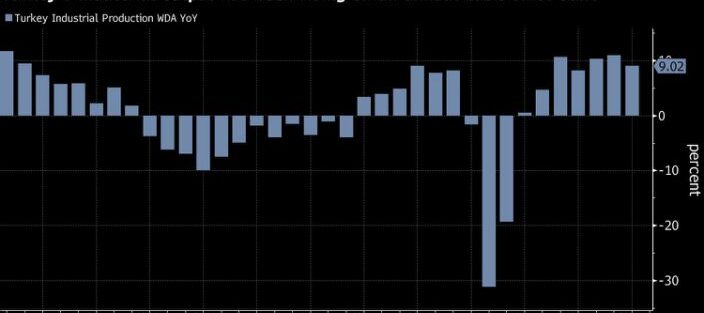

The expansion continues to be driven by a rise in household consumption — estimated to account for about two-thirds of the economy — which jumped 8% from a year earlierThe size of the economy dropped to $717 billion from $760.8 billion in current prices during the same periodExports were unchanged on an annual basis, after falling 22% in the preceding three months. Imports grew 2.5% following a 16% riseGross fixed capital formation, a measure of investment by businesses, rose an annual 10.3%. Government spending increased 6.6%, its largest annual gain since the first quarter of 2019The economy grew by 1.7% in the last quarter from the previous three months when adjusted for seasonality and the number of working days. Overall output rose 1.8% in 2020.

“Strong domestic demand in the past two quarters has been supporting the headline figure through consumption but keeping exports under pressure,” said Can Ayan, an Istanbul-based economist at Aktif Bank. Ayan said the data revealed upside risks to his estimate for 5.2% growth in 2021.

Pandemic Binge

The government pushed banks to ramp up lending to help businesses and consumers ride out last year’s Covid-19 emergency. The credit boom was coupled with a front-loaded easing cycle that helped prime the economy.

But 2020’s growth performance is seen as a primary cause of the lira’s weakness.

Agbal, the central bank chief, raised the benchmark interest rate by a cumulative 675 basis points to 17% following his appointment in November. The lira has strengthened 15% since he took over.

After Monday’s data, the currency was trading 1.6% stronger at 7.31 per dollar as of 10:48 a.m. in Istanbul.

2021 Prospects

The International Monetary Fund raised its growth forecast for Turkey’s economy to 6% in 2021 amid the coronavirus vaccine rollout, while warning the pandemic response worsened pre-existing financial risks despite leading to a strong rebound in economic activity.

“With some stability in the currency market, Turkish exporters can finally enjoy the price competitiveness accumulated over recent years,” said JPMorgan Chase & Co.’s London-based analyst Yarkin Cebeci. “Depending on the pace of vaccinations, tourism will most probably be stronger than last year as well.”

https://finance.yahoo.com/news/pandemic-binge-helped-turkish-economy-070624460.html