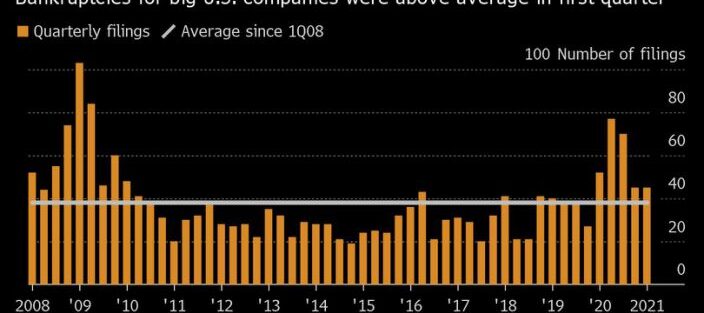

Bankruptcy courts saw a greater-than-average number of filings in the first quarter, though a year-on-year decline highlights the impact of cheap cash flowing to troubled borrowers.

All told, 45 firms with at least $50 million of liabilities sought court protection from creditors in the U.S. during the first three months of the year. The pace matched that of the final quarter of 2020, but it’s slower than the 52 filings seen in the corresponding period of last year.

Excluding 2020, such a pace hasn’t been seen since 2010, which saw 48 filings in the first quarter, according to data compiled by Bloomberg.

U.S. bankruptcy courts are expected to be relatively muted compared with 2020 as ample credit flows to the riskiest companies.

“I don’t see why this year there would be a huge slew of filings,” given the availability of credit to struggling firms, said Adam Plainer, global co-chair of the restructuring group at law firm Dechert.

But the current sluggish state of restructuring doesn’t mean that pandemic-driven distress is over, Plainer said in an interview. The outlook for entertainment and casual dining is uncertain and filings in the energy sector are likely to pick up, he said.

Howard Marks, co-founder of Oaktree Capital Management, bemoans a “challenging” time for traditional distressed investing.

“To get to higher returns these days, you have to be willing to extend credit to somebody who is not clearly coming back,” Marks said in a Bloomberg TV interview on Monday. By the time Oaktree raised capital for a record $15 billion distressed-debt fund in July, “the greatest opportunities were past,” Marks said.

The amount of traded distressed bonds and loans fell to about $92 billion as of April 2, down 1.8% week-on-week, data compiled by Bloomberg show. The amount of troubled bonds rose 0.1% while distressed loans fell 7.5%.

Click here for a worksheet of distressed bonds and loans

There were 243 distressed bonds from 133 issuers trading as of Monday, the lowest since Jan. 6, 2020, according to Trace data.

Diamond Sports Group LLC had the most distressed debt of issuers that hadn’t filed for bankruptcy as of March 26, Bloomberg data show. Its parent company, Sinclair Broadcast Group Inc., said in a March filing that it expects Diamond to have enough cash for the next 12 months if the pandemic doesn’t get worse.

Click here for more news on distressed debt and bankruptcy. First Word is curated by Bloomberg editors to give you actionable news from Bloomberg and select sources, including Dow Jones and Twitter. First Word can be customized to your Worksheet, sectors, geography or other criteria by clicking into Actions on the toolbar or hitting the HELP key for assistance.

https://finance.yahoo.com/news/u-bankruptcy-tracker-first-quarter-130002702.html